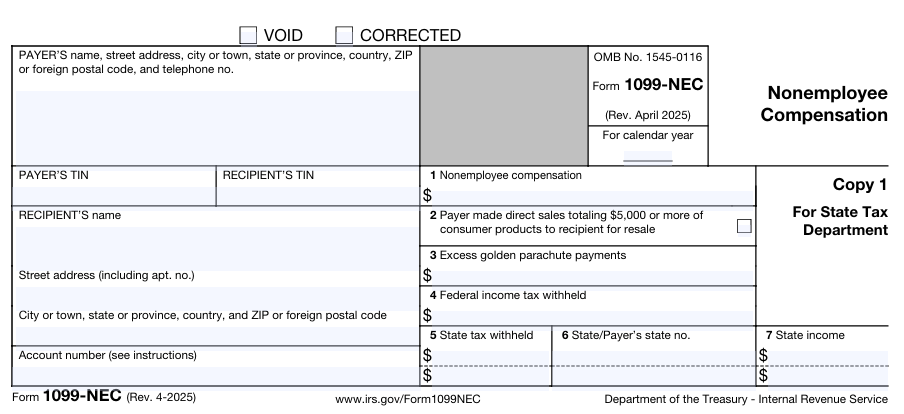

Why Form 1099-NEC matters for landlords

One of my tax clients started renting out the upper floor of his home. Before his tenants moved in, he hired a carpenter for about $1,500 worth of work and a plumber who charged $1,000 for repairs. When he told me he wanted to deduct those expenses on his tax return, I asked if he had issued Form 1099-NEC to the carpenter and plumber by January 31. He looked surprised and asked why he would need to do that for such simple repair work on his rental property.

Form 1099-NEC is used to report “nonemployee compensation,” meaning payments made to independent contractors for services related to your rental property. For many landlords—whether they’re renting out a basement unit, an accessory apartment, or a separate property—the rule is fairly straightforward:

- You pay an individual or non-corporate contractor (sole proprietor, single-member LLC, etc.).

- The payment is for services related to your rental (repairs, cleaning, lawn care, management, etc.).

- Total payments to that contractor are $600 or more during the year.

When these conditions are met, you are generally required to issue Form 1099-NEC to that contractor and file it with the IRS.

Doing this is important because:

- It shows the IRS that your rental activity is being run like a real business, with proper information reporting.

- It supports your right to deduct those contractor payments as legitimate rental expenses on Schedule E.

- It helps avoid penalties for failure to file required information returns.

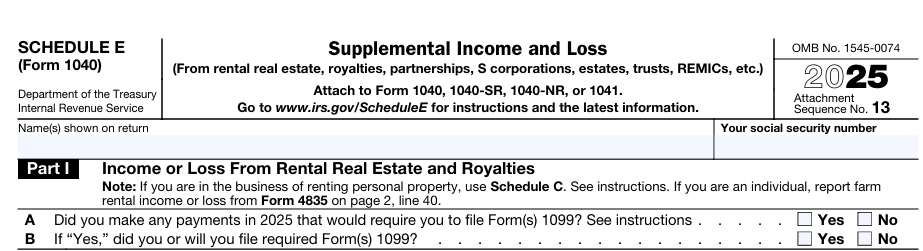

The connection to Schedule E questions

On Schedule E (Supplemental Income and Loss), where you report your rental income and expenses, there are specific questions that ask whether:

- You made payments in the course of your rental activity that would require you to file any 1099 forms, and

- You did, in fact, file all required 1099 forms.

These questions are not just formalities. They essentially ask you to confirm, under penalty of perjury, that:

- You understand the 1099 filing rules, and

- You either had no reportable payments or you complied with the rules.

If you claim large contractor expenses on Schedule E but answer “No” to the question about whether you filed required 1099s, it can raise red flags and increase the likelihood that the IRS will look more closely at your return.

So, when you’re preparing Schedule E, you should pause at those questions and ask yourself:

- Did I pay any nonemployees (contractors) $600 or more for rental-related services?

- Did I collect W-9 forms and use them to issue 1099-NECs by the January deadline?

Your answers affect not just your compliance but also how credible your expense deductions appear if the IRS reviews your return.

Typical rental-related payments that may require a 1099-NEC

Homeowners with rental income often make these kinds of payments:

- Plumbers, electricians, handymen

- Cleaning services for turnovers

- Lawn care and snow removal contractors

- Independent property managers or leasing agents

- Painters or remodelers

If these contractors are not corporations and you pay any of them $600 or more over the year for work tied to your rental, you may be required to issue Form 1099-NEC. Credit card or third‑party platform payments may be reported separately by the processor, but direct checks, cash, Zelle, or Venmo-type payments are normally your responsibility to report.

Real-life stories: what can go right or wrong

Story 1: The “small landlord” who thought 1099s were only for big businesses

Alex owns one rental condo and pays a local handyman about $1,100 during the year for repairs and minor upgrades. The handyman is a sole proprietor. Alex deducts the full amount as repairs on Schedule E but never issues a 1099-NEC, assuming “only companies do that.”

When Alex’s return is selected for review, the IRS sees substantial contractor expenses but a “No” answer to the 1099 question, and requests more documentation. Alex can still substantiate the deductions, but faces extra hassle and potential penalties for failing to file required information returns.

Takeaway: Even small, one‑property landlords should treat 1099 reporting as part of running a legitimate rental activity.

Story 2: The organized landlord who breezes through an audit

Jane rents out the basement of her home and a separate duplex. She:

- Collects Form W-9 from every contractor at the beginning of the relationship.

- Tracks payments by contractor during the year.

- Issues 1099-NECs to any non-incorporated contractor paid $600 or more.

On Schedule E, Jane can honestly answer “Yes” to both 1099 questions. When the IRS later reviews her return, her expense deductions line up with her 1099 filings and W‑9 records, and the review closes quickly with no change.

Takeaway: Proper 1099 compliance strengthens your position on every rental expense you claim.

Story 3: Hiring a friend “under the table”

Sam rents out a spare house and pays a friend $800 in cash over the year to clean between tenants. Neither Sam nor the friend treats it like a real business transaction—no W‑9, no 1099, no paperwork.

Sam deducts the $800 as cleaning expense on Schedule E but answers “No” to the question about having to file any 1099s. If the IRS examines the return, they may view this as a mismatch between claimed expenses and reporting obligations and ask questions about both Sam’s deductions and the friend’s income.

Takeaway: Informal arrangements can create formal tax problems if you’re not careful with 1099 reporting.

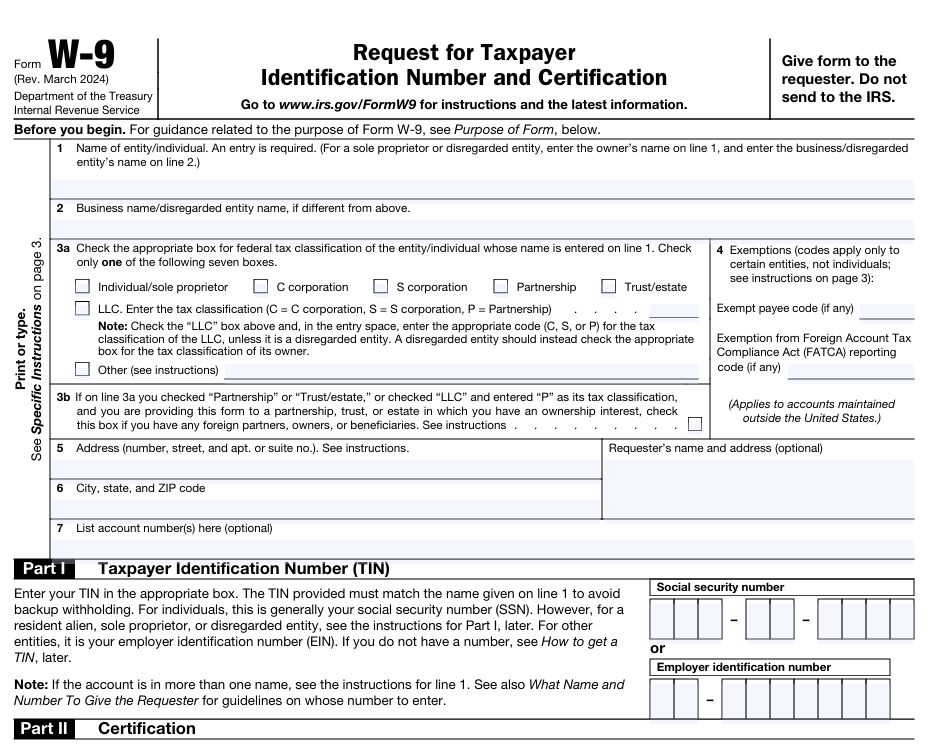

Practical steps for homeowners with rental income

If you own a rental and report it on Schedule E, here are practical habits to adopt:

- Get W-9s early: Before paying a contractor more than a token amount, ask for a completed Form W-9 (name, address, SSN/EIN, business type).

- Track payments by contractor: Use a simple spreadsheet or property management software to total annual payments contractor by contractor.

- Watch the $600 threshold: As soon as you approach $600 for a non-corporate contractor, plan to issue a 1099-NEC.

- File on time: Provide copies to contractors and file with the IRS by the required January deadline each year.

- Answer Schedule E questions accurately: When Schedule E asks whether you were required to file 1099s and whether you did, be prepared to support your answers with documentation.

Reminder about Schedule E

When you prepare your tax return:

- Do not ignore the 1099-related questions on Schedule E—they are there because the IRS links rental expense deductions and contractor payments to 1099 reporting.

- If you answer “No” to having filed required 1099s but claim large contractor expenses, understand that this can invite IRS scrutiny and potentially weaken your position on those deductions.

Treat Form 1099-NEC as part of doing business as a landlord: it protects your deductions, supports your answers on Schedule E, and helps you stay clearly on the right side of the reporting rules.

https://www.irs.gov/pub/irs-pdf/f1099nec.pdf

https://www.irs.gov/pub/irs-pdf/f1040se.pdf

https://www.irs.gov/pub/irs-pdf/fw9.pdf

Note: This article is intended for informational purposes only and does not constitute tax advice. For personalized guidance, please consult a tax professional.