Tip Income and the New 2025–2028 Federal Tip Deduction

For 2025 tax returns, tip income rules largely remain the same — tips are still taxable and must be reported.

However, a new temporary law allows a separate federal income-tax deduction for certain tip income for 2025–2028.

1. What did NOT change

- All tips (cash, credit-card, pooled) are still taxable income

- Tips are still subject to Social Security and Medicare tax

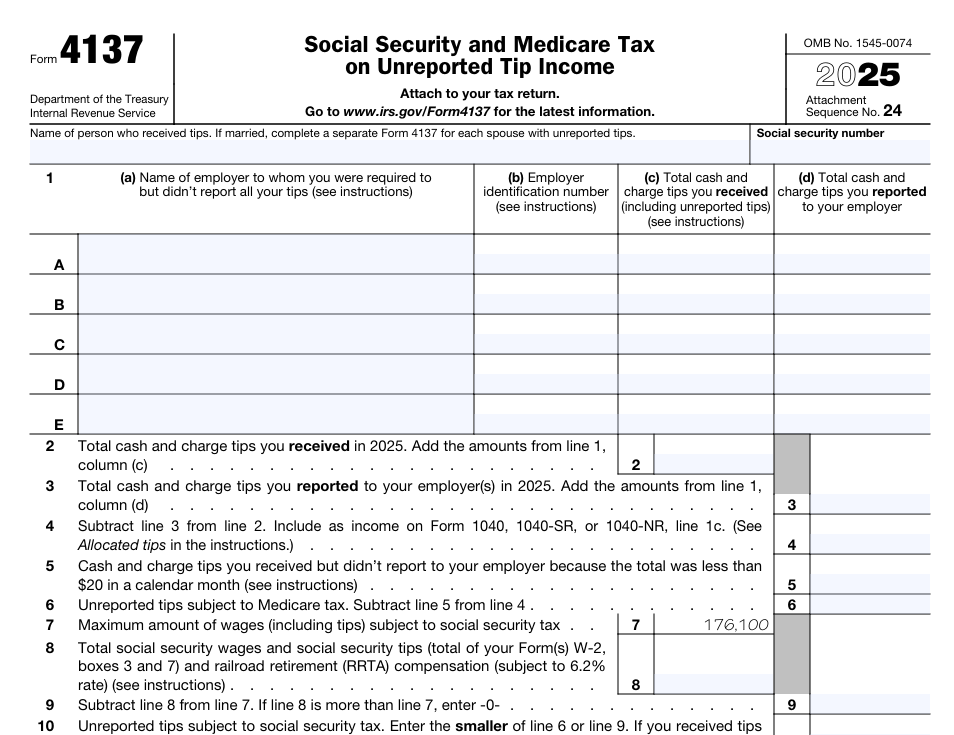

- Unreported tips still require Form 4137

- Self-employed workers still pay self-employment tax

2. What DID change for 2025–2028

A new qualified tip income deduction is available:

- Maximum deduction: $25,000 per year

- Available for employees and self-employed workers

- Subject to MAGI phase-out limits

- Not available to married filing separately

- Does NOT reduce payroll or self-employment tax

This is an income-tax deduction, not an exclusion from wages.

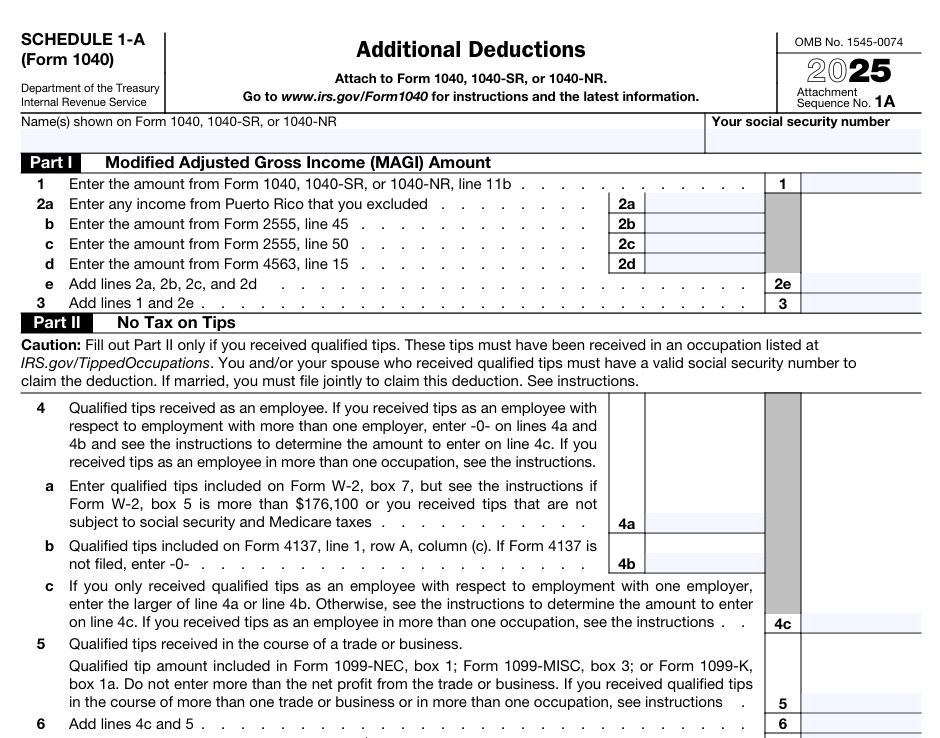

3. Where the tip deduction is claimed (important correction)

For 2025, the IRS places the tip deduction on:

- Form 1040

- Schedule 1-A – Additional Deductions

- Line designated for Qualified Tip Income Deduction (2025–2028)

Key point:

- Wages and tips are fully included in income first

- The deduction is taken after income is reported, through Schedule 1-A

4. Updated real-life examples (with correct forms)

Example 1: Mina — server who reported all tips

Facts

- $15,000 base wages

- $25,000 tips

- All tips reported monthly to employer

- W-2 correctly reflects all tips

Forms used

- Form W-2 → wages including tips

- Form 1040 → wages included in income

- Schedule 1-A (Form 1040) → claims Qualified Tip Income Deduction (up to $25,000)

What she does NOT need

- No Form 4137 (all tips reported timely)

Example 2: Daniel — bartender with unreported cash tips

Facts

- W-2 includes reported wages and card tips

- $5,000 cash tips not reported to employer

Forms used

- Form 4137

- Reports unreported tips

- Calculates additional Social Security and Medicare tax

- Form 1040

- Includes $5,000 in income

- Schedule 1-A (Form 1040)

- Claims Qualified Tip Income Deduction (if eligible)

Result

Daniel pays extra payroll tax via Form 4137, but may still deduct the $5,000 as qualified tips on Schedule 1-A, subject to limits.

Example 3: Lina — self-employed hair stylist

Facts

- Reports $30,000 gross receipts on Schedule C

- $10,000 of that amount is tip income

Forms used

- Schedule C → reports all income

- Schedule SE → calculates self-employment tax

- Form 1040 → includes net profit

- Schedule 1-A (Form 1040) → claims Qualified Tip Income Deduction (up to $10,000)

What she does NOT use

- No Form 4137 (not an employee)

Result

Lina still pays SE tax on tip income, but the deduction on Schedule 1-A reduces her taxable income.

Example 4: Marco — server with allocated tips (W-2 Box 8)

Facts

- W-2 Box 8 shows $3,000 allocated tips

Forms used

- Form 4137

- Reports allocated tips

- Calculates payroll tax

- Form 1040

- Includes allocated tips in income

- Schedule 1-A (Form 1040)

- Claims Qualified Tip Income Deduction (if eligible)

Result

Marco pays payroll tax on allocated tips but may reduce taxable income using the new deduction on Schedule 1-A.

5. Key reminders for 2025

- The tip deduction is not automatic

- It does not reduce Social Security or Medicare tax

- Tips must still be:

- Reported to the employer (employees)

- Included in gross income

- The deduction is claimed only on Schedule 1-A

Note: This article is intended for informational purposes only and does not constitute tax advice. For personalized guidance, please consult a tax professional.