Filing Your 2025 Taxes for Free – IRS Free File and Free Tax Help Options

Many taxpayers still believe that filing a tax return always requires paying for tax software or hiring a professional. For many taxpayers, that assumption is often incorrect. The IRS continues to provide several legitimate ways for eligible taxpayers to file their federal tax return completely free.

If your income and tax situation are relatively straightforward, these programs can save you hundreds of dollars while still allowing you to file securely and accurately.

IRS Free File: Who Qualifies

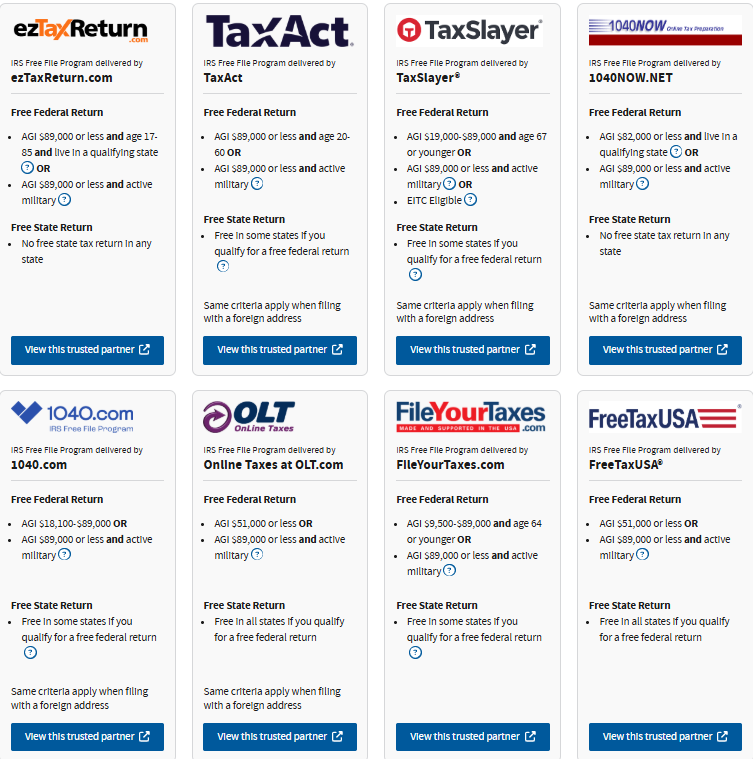

The IRS Free File program is available to taxpayers with adjusted gross income (AGI) under $89,000 per year. Eligible taxpayers can prepare and electronically file their federal tax return at no cost using IRS-approved software providers.

Key benefits of IRS Free File include:

No filing fees for federal tax returns

Electronic filing and direct deposit of refunds

IRS-partnered companies may not use or share your tax return data for non-tax purposes without your voluntary consent

All available IRS Free File partner offers can be reviewed and selected directly through the IRS website:

https://apps.irs.gov/app/freeFile/browse-all-offers/

What You Need Before You File

To complete your return using IRS Free File, the IRS recommends gathering the following information in advance:

Social Security Number or Individual Taxpayer Identification Number

Forms W-2 for wages

Forms 1099 for interest, dividends, or independent contractor income

Dependent information, including Social Security numbers

Documentation for deductions and tax credits

Prior-year AGI or a self-selected PIN to electronically sign your return

Bank routing and account number for direct deposit of refunds

First-time filers over the age of 16 who did not file a prior-year return may enter “0” as their prior-year AGI.

Real-Life Examples

Example 1: Single W-2 Employee

Maria works at a retail store and earned $52,000 in 2025. She received one Form W-2 and has no dependents. She qualifies for IRS Free File and completes her return online in under an hour. Her refund is deposited directly into her bank account within a few weeks, and she pays nothing to file.

Example 2: Married Couple with a Child

James and Hannah are married with one child and earned a combined $78,000 in 2025. They received W-2s and paid daycare expenses. Using IRS Free File, they claim the Child Tax Credit and the dependent care credit at no cost, avoiding both tax preparation fees and software charges.

Example 3: First-Time Tax Filer

Daniel is a college student who worked part-time in 2025 and earned $14,000. This is his first tax return. Since he has no prior-year AGI, he enters “0” to electronically sign his return. He files for free and receives a refund of federal taxes withheld from his paychecks.

Free In-Person Tax Help: VITA and TCE

For taxpayers who prefer face-to-face assistance, the IRS also sponsors free tax preparation programs:

Volunteer Income Tax Assistance (VITA)

Tax Counseling for the Elderly (TCE)

These programs primarily serve:

Low- to moderate-income taxpayers

Seniors

Individuals with limited English proficiency

IRS-certified volunteers prepare and electronically file federal tax returns at no cost.

A nearby free tax preparation site can be located here:

https://irs.treasury.gov/freetaxprep/

Important Notes

IRS Free File applies to federal returns only. State filing availability depends on the software provider and the state. Always access Free File through the IRS website to avoid hidden fees or upsells.

Free filing does not mean lower quality. IRS-approved providers must meet strict security and accuracy standards.

Bottom Line

If your 2025 income is under $89,000, there is a strong chance you can file your 2025 federal tax return in 2026 without paying anything. Through IRS Free File and IRS-sponsored volunteer programs, millions of taxpayers legally and successfully file for free every year.

Note: This article is intended for informational purposes only and does not constitute tax advice. For personalized guidance, please consult a tax professional.