Even Without Selling Investments, Investors May Still Need to File Taxes

I had a tax client who invested in the stock market for the first time and assumed he didn’t need to pay any taxes since he hadn’t sold any of his investments. During the final review of his return, he casually mentioned his new investments, surprised to learn that he might still owe taxes even without any sales. Many Americans share this misunderstanding, believing taxes only apply when they sell stocks, mutual funds, or ETFs. In reality, you may still need to report investment income and file a federal tax return even if you didn’t sell a single share during the year.

Why You Might Owe Taxes Without Selling

The IRS taxes realized income, not just sales. That means:

- Unrealized gains (your investments went up in value but you didn’t sell) are not taxable yet.

- But dividends, interest, and capital gain distributions paid during the year are taxable, even if automatically reinvested.

Mutual funds and ETFs often distribute taxable income each year, even when investors don’t sell any shares.

Personal Story: Retiree Surprised by Dividend Taxes

John, 68, from Florida, lives mostly on Social Security and a portfolio of blue-chip stocks. He didn’t sell any investments last year and assumed he wouldn’t owe anything.

“But when my CPA showed me my 1099-DIV, I had over $4,000 in dividends,” John said. “I didn’t realize those were taxable even if I just left them in my account.”

Dividend income is taxable and must be reported if you’re required to file a return.

Reporting Dividend and Interest Income

If you earn investment income, your broker typically issues:

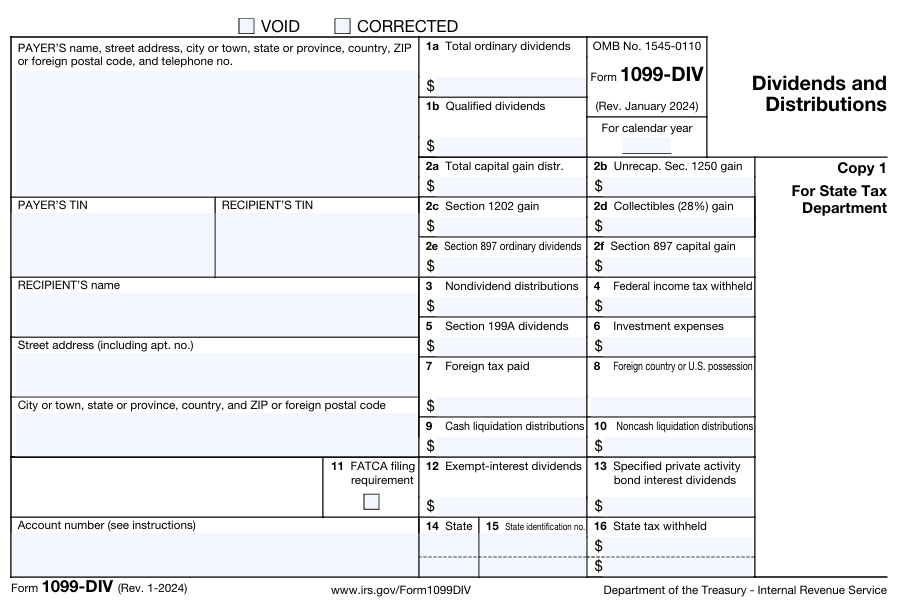

- Form 1099-DIV for dividends and capital gain distributions

- Form 1099-INT for interest income

You must report the income even if you don’t receive a form.

Personal Story: Young Investor With Reinvested Dividends

Maria, 29, from Texas, invests in ETFs through an app and reinvests every dividend.

“I never touched the money, so I thought it didn’t count,” she said. “But my tax software asked for my 1099-DIV, and suddenly I owed more tax than I expected.”

Reinvested dividends are still taxable in the year received.

When You’re Required to File a Return

Whether you must file depends on income, filing status, and age. Investment income counts toward those thresholds. Even taxpayers below normal income limits may choose to file to report investment income or claim refunds.

Personal Story: High Earner Hit by NIIT

David, 52, from California, didn’t sell any investments but earned large dividends and interest from his portfolio. “My CPA told me I also owed the 3.8% Net Investment Income Tax,” David said. “I had no idea that applied without selling anything.” High-income taxpayers may owe the Net Investment Income Tax (NIIT) on dividends, interest, and other investment income.

Cash vs. Reinvested Income

Whether you take investment income in cash or reinvest it, the IRS treats it the same for tax purposes.

Bottom Line

Even if you didn’t sell any investments, you may still need to file a tax return and report income if you received:

- Dividends from stocks, mutual funds, or ETFs

- Interest from bonds or savings

- Capital gain distributions from funds

Failing to report this income can trigger IRS notices and penalties. Reviewing all 1099 forms from brokers and banks each year is essential.

Note: This article is intended for informational purposes only and does not constitute tax advice. For personalized guidance, please consult a tax professional.