Do Past Tax Mistakes Really Threaten Your Green Card?

If you are an F‑1 student, J‑1 exchange visitor, or E‑2 employee thinking about applying for a green card (Form I‑485), you may be replaying old tax seasons in your head.

Did you use the wrong form? Claim a deduction you weren’t eligible for? Forget Form 8843 one year?

These concerns are very common — and often overstated. For most applicants, honest technical mistakes, once corrected, do not derail a green card case.

Why Visa Holders Often Make Tax Mistakes

F‑1 and J‑1 students are often classified as nonresident aliens for tax purposes during their early years in the United States. E‑2 employees in their first year may also be treated as nonresidents if they do not meet the Substantial Presence Test.

It is therefore easy — and very common — to make technical filing errors, such as:

- Filing Form 1040 instead of Form 1040‑NR

- Claiming the standard deduction when not eligible

- Incorrectly claiming education credits

- Failing to file or attach Form 8843

- Filing as a full‑year resident instead of dual‑status when both nonresident and resident periods exist

For most F‑1, J‑1, and E‑2 filers, these are technical compliance mistakes, not signs of fraud or intentional tax evasion.

The IRS Gives You a Way to Fix Mistakes

The good news: the U.S. tax system assumes people will sometimes make mistakes — and it gives you a formal way to correct them.

If you discover that you filed the wrong form or claimed something you should not have, you can usually fix it by filing Form 1040‑X, Amended U.S. Individual Income Tax Return, and paying any additional tax and interest that may be due.

When you do this:

- You show that you are taking responsibility.

- You demonstrate that you are trying to comply with U.S. law, not hide from it.

For immigration purposes, a corrected return generally looks far better than an uncorrected mistake.

How Much Does Form I‑485 Care About Tax Technicalities?

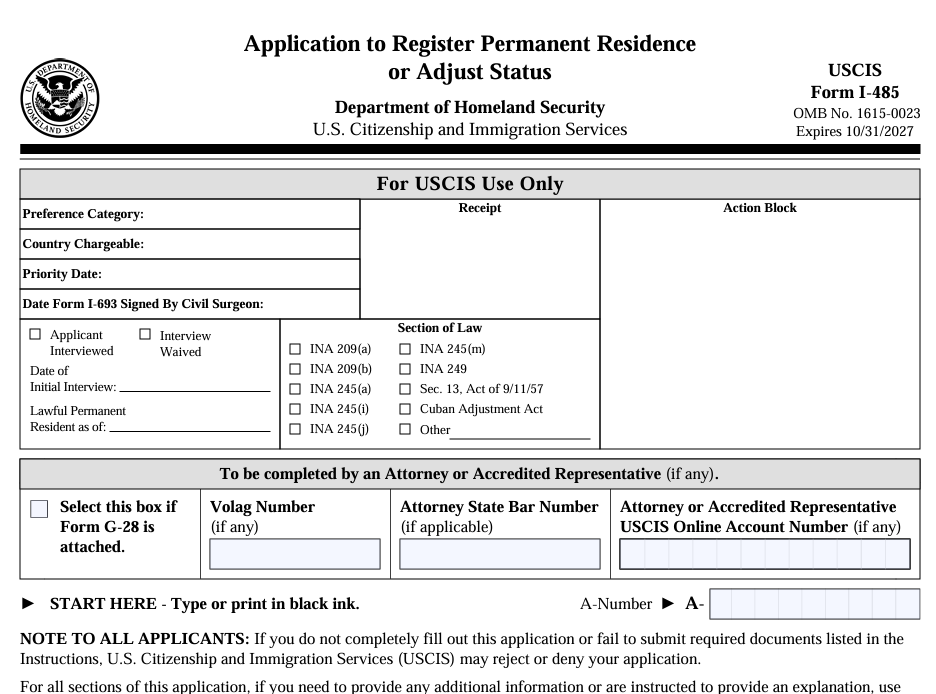

Many applicants are surprised to learn that Form I‑485, Application to Register Permanent Residence or Adjust Status, does not ask detailed questions about:

- Which tax form you filed

- Whether you filed Form 1040 or Form 1040‑NR

- Whether you amended a past return

Instead, I‑485 focuses on:

- Your immigration history

- Grounds of inadmissibility (health, security, prior violations, etc.)

- Criminal background and security‑related issues

- Truthful representation and documentation

In short, the form is not designed to audit your tax technicalities. What matters more is whether you have obeyed U.S. law in a general sense and whether you have been honest in your applications.

How Tax Issues Can Come Up in a Green Card Interview

Even though tax returns are not always filed with I‑485, tax compliance can still surface during an interview or later review. An officer may ask questions or look more closely if there are red flags, such as:

- Required federal tax returns were never filed

- There is significant unpaid federal tax debt with no payment plan in place

- Your employment history on immigration forms does not match what appears in tax records

These situations can raise concerns about overall compliance with U.S. law or about misrepresentation. By contrast, correcting a technical filing error through an amended return — before the interview — is typically seen as a responsible step, not a negative one.

For J‑1 applicants, a more serious issue is often the two‑year home residency requirement under Section 212(e), and whether it applies or has been waived. That requirement generally matters more for immigration eligibility than whether you used 1040 versus 1040‑NR in a past tax year.

Why Early Review Is So Important

If you are an F‑1, J‑1, or E‑2 employee considering permanent residency, it is wise to review your prior tax filings before you begin the green card process. Practical steps include:

- Gathering your prior‑year federal returns and W‑2/1099 forms

- Checking whether you used the correct nonresident vs. resident form in each year

- Confirming whether Form 8843 was filed when required

- Filing amended returns (Form 1040‑X) where you find mistakes

- Paying any additional tax due and setting up a payment plan, if necessary

- Obtaining official IRS transcripts as proof of filing and payment history

Doing this early reduces anxiety and lets you enter the immigration process with cleaner records and stronger documentation if questions arise.

Key Takeaway: Compliance Matters More Than Perfection

Immigration officers are primarily focused on:

- Lawful status and history

- Admissibility (security, health, prior violations)

- Truthful, consistent information across your applications and supporting documents

In most cases, a properly amended tax return — especially for a technical issue made in good faith — does not, by itself, threaten a green card application.

For F‑1 students, J‑1 visitors, and E‑2 employees, the goal is not a “perfect” tax history, but a transparent and compliant one. Identifying mistakes, correcting them proactively, and keeping clear records shows exactly what USCIS wants to see: that you take your obligations seriously and are willing to make things right.

Note: This article is intended for informational purposes only and does not constitute tax advice. For personalized guidance, please consult a tax professional.