Why Most Taxpayers Take the Standard Deduction Instead of Itemizing

Each year, millions of Americans preparing their federal income tax returns face the same question:

Should I take the standard deduction or itemize deductions on Schedule A?

While both options can reduce taxable income, data shows that most taxpayers now choose the standard deduction. Here’s why.

What Is the Standard Deduction?

The standard deduction is a fixed dollar amount the IRS allows taxpayers to subtract from income before calculating tax. It varies by filing status and is adjusted annually for inflation. The biggest advantage is simplicity — no receipts or detailed records are required.

Standard Deduction Amounts for 2025 and 2026

Tax year 2025 (filed in 2026) standard deduction amounts are:

- Single: $15,750

- Married Filing Jointly: $31,500

- Head of Household: $23,625

- Married Filing Separately: $15,750

Tax year 2026 (filed in 2027) standard deduction amounts are:

- Single: $16,100

- Married Filing Jointly: $32,200

- Head of Household: $24,150

- Married Filing Separately: $16,100

Many taxpayers who are 65 or older or blind may be eligible for additional standard deduction amounts on top of these base figures.

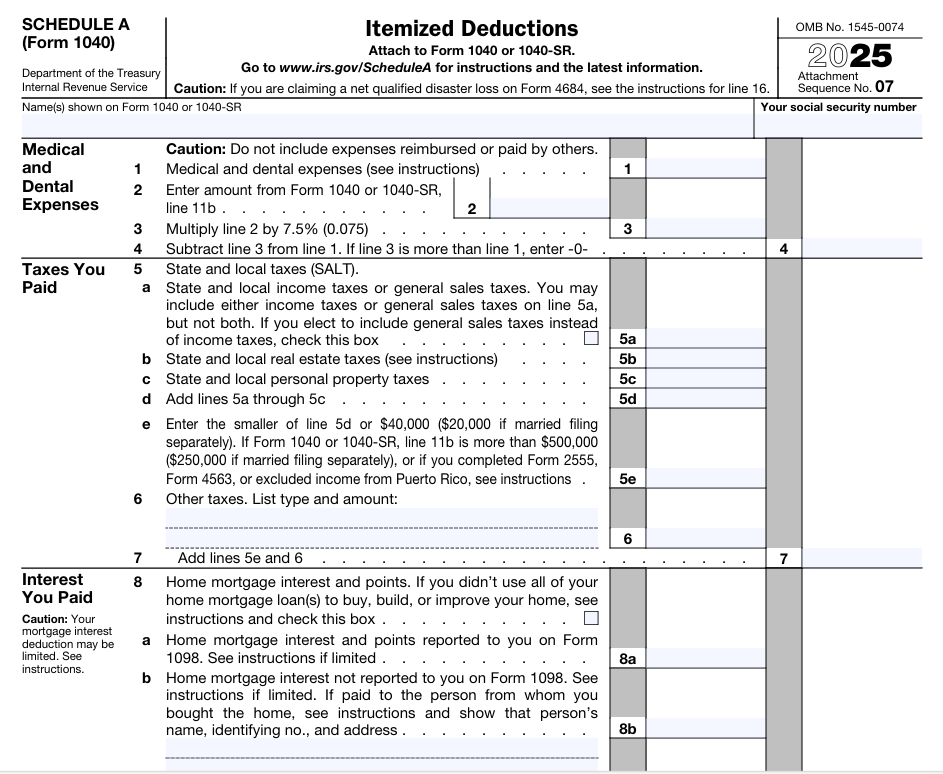

What Are Itemized Deductions?

Itemized deductions include expenses like:

- Mortgage interest

- State and local taxes (SALT)

- Charitable contributions

- Qualifying medical costs

Taxpayers benefit from itemizing only when the total exceeds the standard deduction.

How Many Taxpayers Take Standard vs. Itemized

Recent data shows a clear trend:

- About 90–91% of taxpayers claim the standard deduction

- Only about 8–10% itemize their deductions

Before 2017, roughly 30–36% of taxpayers itemized, but that number dropped sharply in recent years.

The Impact of the Tax Cuts and Jobs Act of 2017 (TCJA)

The shift toward the standard deduction began with the Tax Cuts and Jobs Act of 2017 (TCJA). The law:

- Eliminated personal exemptions that had previously allowed an exemption amount per taxpayer and dependent

- Nearly doubled the standard deduction starting in 2018

As a result, many taxpayers found the boosted standard deduction more valuable than itemizing, reducing paperwork and simplifying filing. This change drove the share of taxpayers who itemize down from about 30% before TCJA to under 10% today.

Why Most Taxpayers Prefer the Standard Deduction

1. A Much Larger Deduction

TCJA and subsequent inflation adjustments substantially increased the standard deduction, making it higher than what many households could achieve through itemized deductions.

Many taxpayers simply don’t have enough deductible expenses to surpass the standard amount.

2. Limits on Itemized Deductions

Itemized deductions like SALT have been limited (e.g., SALT cap), which reduces the incentive to itemize for many filers.

3. Simplicity

Taking the standard deduction requires no receipts or tracking of expenses, saving time and effort.

4. Income Level Matters

Higher-income taxpayers with significant deductible expenses are more likely to itemize, but most middle-income taxpayers do not exceed the standard deduction with their itemized totals.

Key Takeaways

- Over 90% of taxpayers take the standard deduction rather than itemizing.

- Only about 8–10% itemize, usually those with large deductible expenses.

- Standard deduction amounts for 2025 range from $15,750 (single) to $31,500 (married filing jointly).

- For 2026, standard deduction amounts increase to $16,100 (single) and $32,200 (married filing jointly).

- Simplicity and larger deduction amounts make the standard deduction the better choice for most filers.

Note: This article is intended for informational purposes only and does not constitute tax advice. For personalized guidance, please consult a tax professional.