Roth IRA Withdrawal in 2025: What Tax Forms Arrive — and How One Family Avoided Penalties

When 36-year-old Jason Miller needed $4,000 in 2025 to cover emergency car repairs so he could keep commuting to work, he didn’t reach for a credit card. Instead, he tapped his Roth IRA — but only the money he had contributed over the years.

“I was nervous,” Miller said. “I’d always heard retirement accounts mean penalties. But my advisor told me Roth contributions are different.”

He was right. And like thousands of Americans who withdraw Roth IRA contributions before age 59½, Miller soon learned that while the money can be tax-free, the IRS still wants paperwork.

Here’s what happens when you withdraw Roth IRA contributions in 2025, what tax forms you’ll receive, and how to report it on your return.

Roth IRA basics: why contributions can come out tax-free

Roth IRAs are funded with after-tax dollars, so the IRS allows you to withdraw your regular contributions at any time, for any reason, without:

- income tax, or

- the 10% early-withdrawal penalty.

For more information,

https://monieguide.com/estate-planning/2025/roth-ira-as-a-financial-safety-net-when-retirement-savings-become-emergency-support/

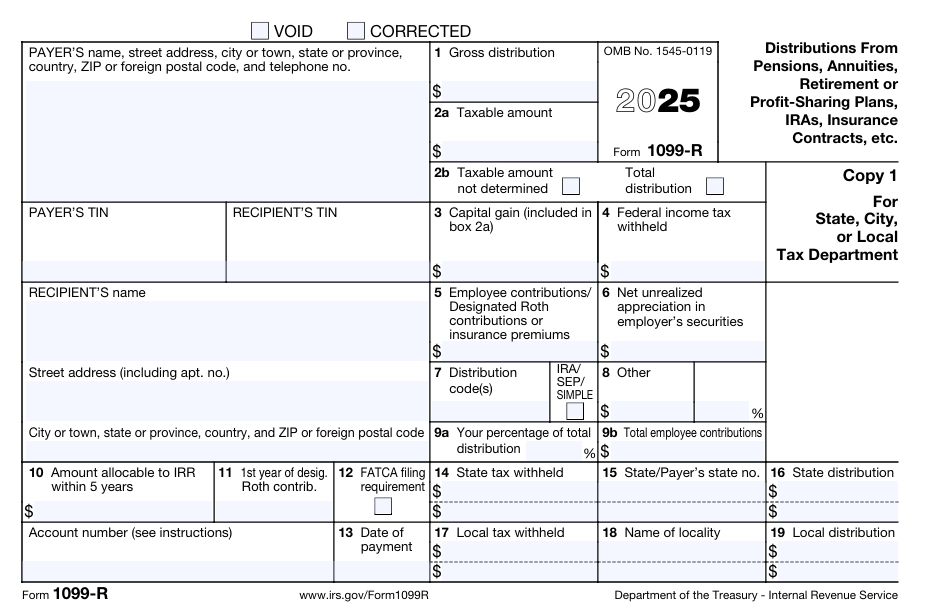

The tax form you will receive: Form 1099-R

If you withdraw from a Roth IRA in 2025, your IRA custodian will send you:

Form 1099-R

- When: By January 31, 2026

- What it shows:

- Box 1: total distribution

- Box 2a: taxable amount (often $0 for Roth)

- Box 7: distribution code (commonly “J” = early Roth distribution)

Even if the withdrawal is completely tax-free, the IRS still receives a copy — so you must report it.

Miller received his 1099-R in late January. Box 1 showed $4,000. Box 2a was zero. Box 7 had code “J.”

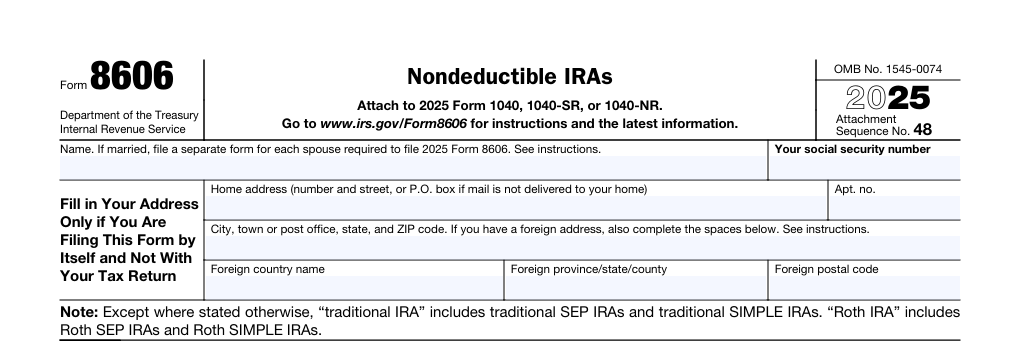

The form you usually must file: Form 8606

To prove that your Roth IRA withdrawal came from contributions and not earnings, you typically file:

Form 8606 (Part III) with your tax return

Form 8606 tracks your Roth IRA basis — the total of all contributions you’ve made over the years — and shows the IRS why your distribution isn’t taxable.

Without it, the IRS may assume part of your withdrawal was earnings and send a tax bill.

https://www.irs.gov/forms-pubs/about-form-8606

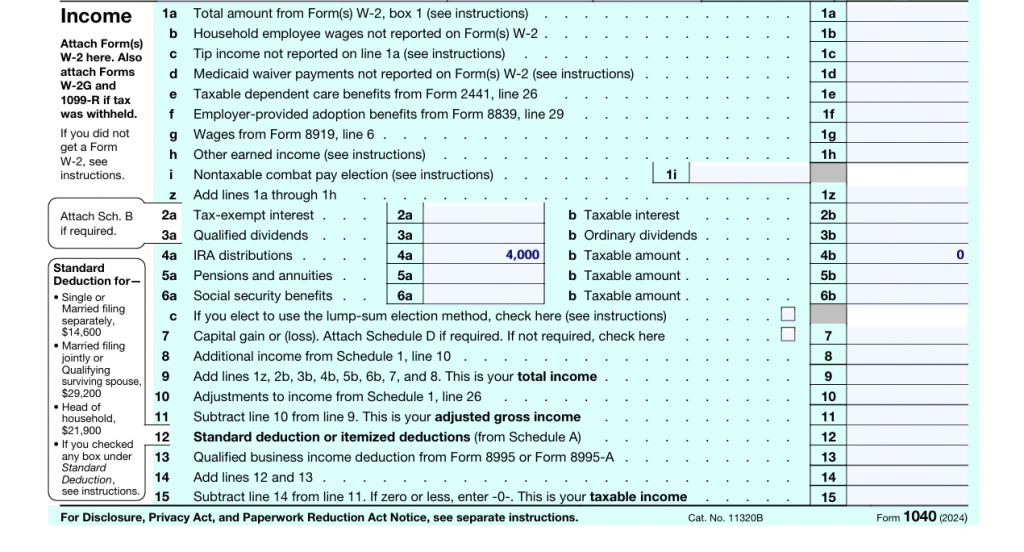

Where it goes on your tax return

On your Form 1040 for 2025, you will:

- Report the total distribution on the line for IRA distributions (currently Line 4a), and

- Report the taxable amount (often $0) on Line 4b.

Then you attach Form 8606 to show that the amount came from contributions.

If you only withdrew contributions:

- ✔️ No income tax

- ✔️ No 10% penalty

- ❌ No Form 5329 needed (that form is only for penalties)

https://www.irs.gov/publications/p590b

Forms you might also see

- Form 5498 – reports your Roth contributions and account value.

It’s for your records and usually arrives in May. It does not report withdrawals.

https://www.irs.gov/forms-pubs/about-form-5498

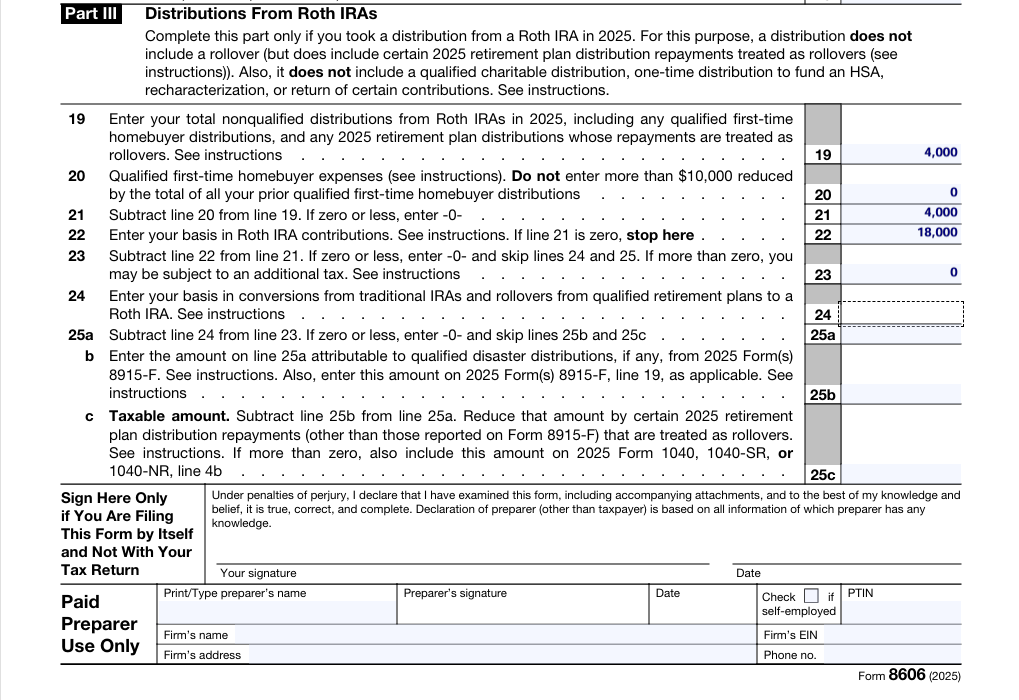

Real life: how Jason filed his return

Miller had contributed about $18,000 to his Roth IRA over several years. After withdrawing $4,000 in 2025:

- He received Form 1099-R in January 2026.

- His tax software entered the 1099-R.

- He completed Form 8606, showing his remaining basis.

- On Form 1040, Line 4a showed $4,000, Line 4b showed $0.

“That was it,” he said. “No tax, no penalty — but I’m glad I didn’t ignore the form.”

What you should expect in 2025

If you withdraw Roth IRA contributions before age 59½ in 2025:

You will receive Form 1099-R in early 2026

You should file Form 8606 with your return

You report the distribution on Form 1040

If it’s only contributions, the taxable amount is $0

Keep records of all Roth contributions you’ve ever made

Important cautions

- Your custodian does not track your contribution history — you must.

- If you accidentally dip into earnings, that part may be taxable and subject to a 10% penalty.

- Once withdrawn, Roth contribution space is usually lost forever.

Bottom line

Withdrawing Roth IRA contributions in 2025 can be a smart emergency move — but only if you handle the tax reporting correctly.

As Miller put it, “The money helped me get through a tough spot. The paperwork helped me keep it tax-free.”

Knowing which forms to expect — and which ones to file — can make the difference between a penalty-free lifeline and an unexpected IRS letter.

Note: This article is intended for informational purposes only and does not constitute tax advice. For personalized guidance, please consult a tax professional.