Life Stories from Your Tax Forms #01

How a 401(k) Built a Comfortable Retirement

One of my clients is a married couple in their mid‑60s. They worked for many years, lived modestly, and did not chase a fancy lifestyle. Instead, they made a clear choice: “We will save first, then spend what is left.” That simple rule guided their whole working life.

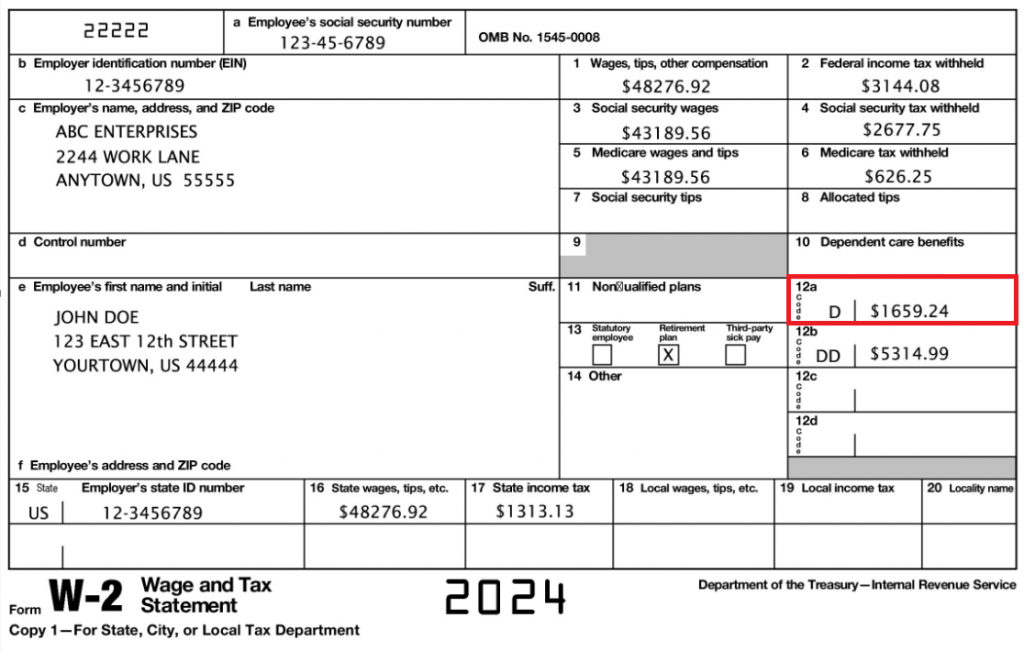

When I reviewed their Form W‑2, I paid special attention to Box 12, Code D. Next to Code D, the amount was $30,494.79. Code D shows how much money they chose to send from their paycheck into their traditional 401(k) plan for that year. In 2025, the basic 401(k) employee limit is $23,500, and people age 50 or older can add another $7,500 as a “catch‑up” amount, for a total of $31,000. This means they are contributing almost the maximum allowed for their age (For those ages 60 to 63, it may be possible to contribute up to $34,750 in 2025 by using a “super” catch‑up contribution, if their plan allows it).

They have been doing this not just for one year, but for many years in a row. Each year, they set their 401(k) contribution first, then built their monthly budget around what was left. That number next to “D” on their W‑2 is not just a tax detail. It is a sign of a long‑term habit: choosing future security over short‑term spending.

Today, they are seeing the results. Their retirement savings are more than enough to cover their living costs and give them freedom. They can travel, enjoy hobbies, and help their children and grandchildren when needed. They do not have to lie awake at night worrying about money. They did not get here by luck or by finding some magic investment. They got here through steady saving and using the 401(k) rules in a smart way.

The Lesson: Your “D Number” Is a Mirror

This couple’s story shows how powerful time and consistency can be. When you start saving early and keep going year after year, compound growth has time to work. Small amounts repeated often can become a large balance later. Many people wait until their 50s or 60s to take retirement saving seriously. Some of them now contribute a lot, but many tell me, “I wish I had started this 20 years earlier.” Time is something you cannot get back.

Your Code D amount is like a mirror. It reflects your current saving habits and, in many ways, your lifestyle choices. A higher D amount usually means you are willing to live within your means now so you can have more freedom later. A very low or zero D amount may mean that most of your income is going to today’s spending, not tomorrow’s security.

Understanding Box 12, Code D on Your W‑2

You can learn something important just by reading your own tax form. Take out your Form W‑2 and follow these steps:

- Find Box 12 on the form.

- Look for the line with Code “D”.

- Read the dollar amount next to it.

That number shows how much of your pay you decided to put into your traditional 401(k) this year. For workers 50 or older in 2025, that number can be up to $31,000 if the plan allows the full basic and catch‑up contributions. This money is not included in your taxable wages for the year. Instead, it goes into your 401(k) account and can grow without being taxed each year. You will pay income tax when you withdraw it in retirement, when your tax rate may be lower.

For my retired clients in this story, the $30,494.79 next to Code D is evidence of years of discipline. Their W‑2 is more than just a form for tax filing; it is a record of the decisions that made their retirement comfortable.

For 2026, you can contribute up to $24,500 to your 401(k) from your own salary. If you’re 50 or older, you can add a catch‑up amount for a total of $32,500. If you’re between ages 60 and 63 and your plan offers the special “super” catch‑up, your personal limit can be as high as $35,750 instead of $32,500.

Note: This article is intended for informational purposes only and does not constitute tax advice. For personalized guidance, please consult a tax professional.