Is the Stock Market in an AI Bubble?

In recent years, stocks tied to artificial intelligence (AI) have surged. Big companies that make computer chips, software, and cloud services have seen their stock prices climb fast. Many people are excited about how AI could change the world.

But some investors are asking: Is this a real growth story, or is it a bubble?

A bubble happens when prices rise far above what businesses are really worth, mostly because people expect prices to keep going up. When confidence breaks, prices can fall quickly.

Why Some Say the Market Is in an AI Bubble

1. Prices have risen very fast

Many AI-related stocks have doubled or tripled in a short time. When prices rise faster than company profits, it can be a warning sign.

2. Hype is everywhere

Companies often add “AI” to their plans to attract investors. In past bubbles, buzzwords like “internet” or “blockchain” did the same thing.

3. Big money chasing a few stocks

A small group of tech giants now drives a large part of stock market gains. If they stumble, the whole market could feel it.

4. Future hopes, not today’s profits

Some AI projects cost billions and may not pay off for years. If results disappoint, investors could pull back.

Why Others Say It’s Not a Bubble

1. Strong profits at major companies

Unlike many past bubbles, today’s largest AI companies already earn billions of dollars.

2. AI has real uses

AI is being used in medicine, finance, customer service, and more. This isn’t just an idea — it’s already changing businesses.

3. Valuations aren’t as extreme as before

Some experts say today’s prices, while high, are not as wild as during the dot-com bubble of the late 1990s.

4. Long-term growth story

Supporters believe AI could be as important as electricity or the internet, justifying big investment today.

Historical Bubble Stories

Looking at history helps investors understand what bubbles feel like.

Tulip Mania (1600s – Netherlands)

In the early 1600s, tulips became a symbol of wealth in the Netherlands. Some rare tulip bulbs were so popular that people traded them like money. Ordinary workers spent their savings, and some even borrowed money, hoping to resell bulbs at higher prices. At the peak, a single bulb could cost more than a nice home.

Then in 1637, buyers suddenly stopped showing up at auctions. Fear spread, prices crashed, and many people were left with bulbs worth almost nothing.

Lesson: When prices depend only on hope that someone else will pay more, markets can collapse fast.

Dot-Com Bubble (Late 1990s)

When the internet became popular in the 1990s, investors rushed to buy stocks of any company connected to it. Many businesses had little revenue and no profits, but their stock prices soared just because they had “.com” in their name. Some companies went public without even having a clear plan to make money.

By 2000, reality hit. Investors realized most of these firms could not earn enough to survive. Stock prices crashed, thousands of companies failed, and trillions of dollars in value disappeared from the market.

Lesson: New technology can change the world, but not every company will succeed.

Housing Bubble (2000s)

In the early 2000s, home prices in the U.S. rose quickly. Banks offered easy loans, even to people with weak credit. Many buyers believed house prices could only go up, so they bought bigger homes or multiple properties to flip for profit.

When interest rates rose and homeowners couldn’t pay their loans, foreclosures surged. Home prices fell sharply, banks suffered huge losses, and the global financial system nearly collapsed in 2008, causing a deep recession.

Lesson: Easy credit and belief that prices “can’t fall” can lead to major crises.

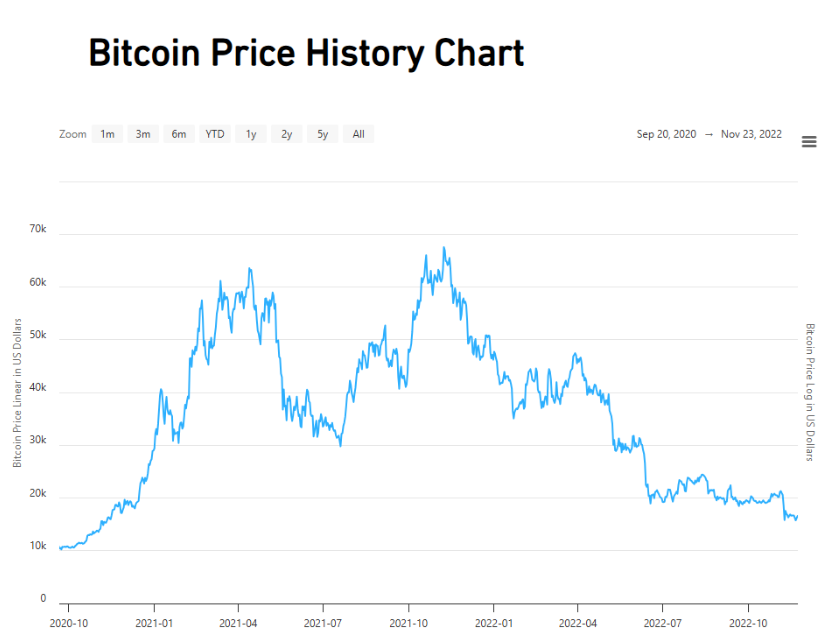

Cryptocurrency Boom (2020–2021)

During the pandemic, millions of new investors poured into cryptocurrencies like Bitcoin and Ethereum. Social media hype, celebrity support, and stories of overnight millionaires drove prices higher. Some people invested money they couldn’t afford to lose.

In 2022, rising interest rates, major failures, and fraud cases shook confidence. Prices plunged, wiping out hundreds of billions of dollars in value and leaving many investors with heavy losses.

Lesson: Exciting new assets can rise fast, but they can fall just as quickly.

How AI Compares to Past Bubbles

Similarities:

- Big excitement about new technology

- Fear of missing out

- Fast price increases

Differences:

- Many AI leaders already make real profits

- AI tools are widely used today

- Big firms have strong balance sheets

This is why experts disagree: AI looks powerful, but prices may still be too high.

What This Means for Investors

No one knows for sure if today’s market is a bubble. That’s why financial planners often suggest:

- Diversify — don’t bet everything on one sector

- Think long-term — avoid chasing hot trends

- Focus on fundamentals — profits, cash flow, and business strength

- Accept ups and downs — markets always move in cycles

Bottom Line

AI may truly transform the economy — but history shows that even great ideas can become overhyped in markets. Whether this is a bubble or just strong growth won’t be clear until later. Smart investors balance excitement with caution.

Note: This article is intended for informational purposes only and does not constitute tax advice. For personalized guidance, please consult a tax professional.