Form 8843: Why International Students Must File It Even With No U.S. Income

Many international students are surprised to learn that they may still have a U.S. tax filing obligation even if they earned no U.S. income at all.

For students and scholars in F or J status, that obligation is often Form 8843.

Form 8843 is one of the most misunderstood IRS forms for international students. This article explains what it does, who must file it, how to file it, and why it matters—especially if you have foreign income or assets.

1. What Form 8843 Does (And Does Not Do)

What Form 8843 is

Form 8843 is:

- An informational statement, not a tax return

- Not a tax bill

- Used to explain why certain days you were physically present in the U.S. should be excluded from the Substantial Presence Test (SPT)

For most F-1 and J-1 students, this is how you claim your status as an “exempt individual” for SPT purposes during the allowed years.

What Form 8843 does NOT do

Form 8843:

- Does not report income

- Does not calculate tax

- Does not list foreign bank accounts, foreign income, or foreign assets

- Does not by itself make you a U.S. tax resident

Think of Form 8843 as a status-protection form, not an income reporting form.

2. Who Must File Form 8843 (Even With No U.S. Income)

You must file Form 8843 if all of the following apply:

- You were present in the U.S. at any time during the year

- You are a nonresident alien for tax purposes

- You were in F-1, F-2, J-1, or J-2 status

- You are within an exempt period for students or scholars

You must file even if:

- You had no U.S. job

- You received no scholarship

- You earned only foreign income

- You have no SSN or ITIN (you do not need to apply for one just to file Form 8843)

If you already have an SSN or ITIN, you must list it on the form.

3. Real-Life Examples: Who Files Form 8843?

Example 1: Student With Only Foreign Income

Min-soo is an F-1 student from Korea.

In 2025:

- He did not work in the U.S.

- His parents sent money from Korea

- He earned interest from a Korean bank account

Even though none of that income is U.S.-source, Min-soo must file Form 8843 to maintain his exempt status.

Example 2: Student With No Income at All

Anna is a J-1 exchange student.

- No U.S. income

- No foreign income

- No SSN

Anna still must file Form 8843.

This filing proves she is properly excluding her U.S. days from the SPT.

Example 3: Dependent Spouse

David is in F-2 status as the spouse of an F-1 student.

- He cannot work

- No income anywhere

David still files Form 8843, even though he files no tax return.

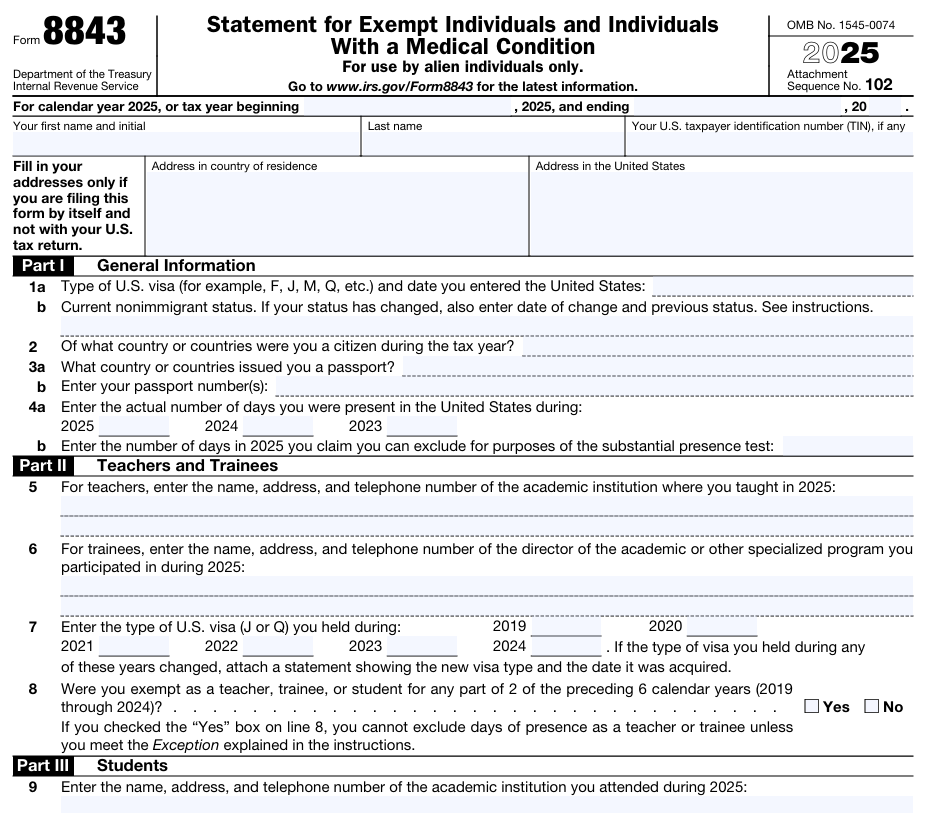

4. How to Complete Form 8843 (Typical F-1 / J-1 Student, No U.S. Income)

Heading

- Name and U.S. address

- SSN/ITIN if you have one

If you do not have one and have no return filing requirement, no application is required.

Part I – General Information

- Visa type (F-1 or J-1)

- Country of citizenship

- Passport number

- Number of days present in:

- Current year

- Prior year

- Second prior year

Part III – Students

- School name and address

- Visa type

- Calendar years in F or J status

- Whether you previously claimed exempt status

If you transferred schools or attended more than one institution, list them.

No Income Reporting

There are no income lines on Form 8843.

Foreign salary, foreign interest, foreign rental income, and foreign assets do not appear anywhere on this form.

5. How and Where to File

- No U.S.-source income

File Form 8843 by itself, by mail, to the address listed in the instructions - U.S.-source income in another year

Attach Form 8843 to Form 1040-NR

Electronic filing is generally not available when filing Form 8843 alone.

6. Why Form 8843 Is Especially Important If You Have Foreign Assets

For international students, tax residency timing matters.

While you remain a nonresident alien:

- Generally only U.S.-source income is taxable

- Foreign income and assets are usually outside U.S. taxation

- Certain foreign reporting rules generally do not apply

Once you become a resident alien (by meeting the SPT or obtaining a green card):

- The U.S. can tax worldwide income

- Additional foreign reporting rules may apply

Filing Form 8843 every year protects your nonresident status during eligible years and helps delay worldwide taxation legally.

7. Common Mistake: “I Had No Income, So I Didn’t File Anything”

This is one of the most common errors international students make.

Not filing Form 8843:

- Does not automatically make you a tax resident

- But weakens your documentation

- Can create problems later if residency is questioned

Form 8843 is a paper trail that supports your tax status.

Final Takeaway

If you are an international student or dependent in F or J status, Form 8843 is required almost every year you are in the U.S., even when:

- You earned no U.S. income

- You earned only foreign income

- You have no SSN or ITIN

It is a simple form, but it plays a critical role in protecting your nonresident tax status.

Note: This article is intended for informational purposes only and does not constitute tax advice. For personalized guidance, please consult a tax professional.