Form W-2 Tip Reporting Explained: Understanding the Difference Between Box 7 and Box 8

If you work in a restaurant or bar, you may have said something like this:

“I don’t remember ever reporting my tips.”

Yet every year, when Form W-2 arrives in late January or early February, many employees notice something confusing:

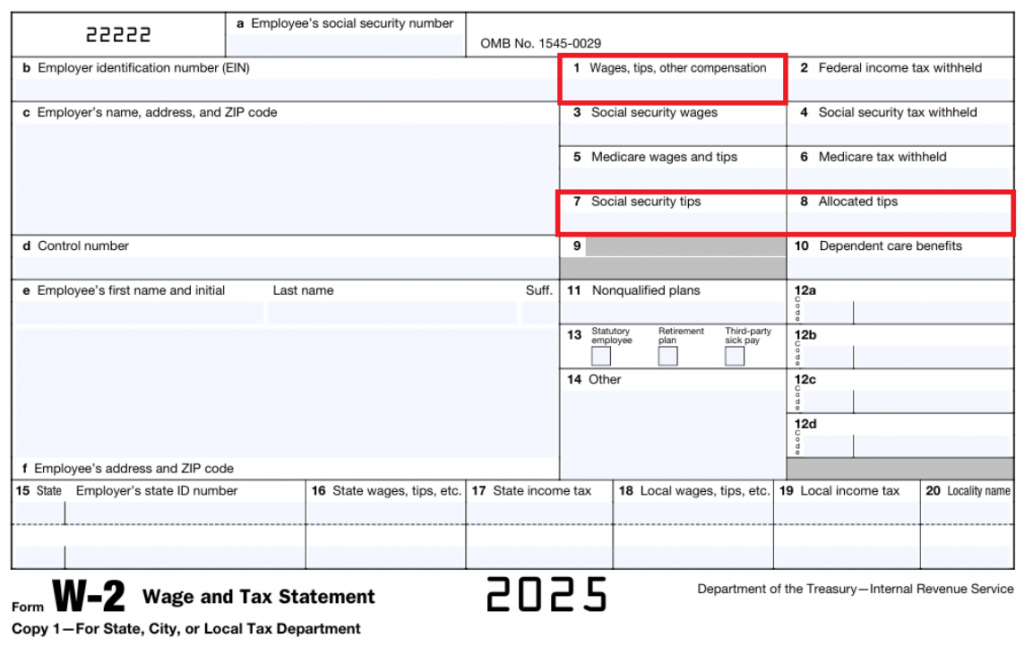

Tip income appears in two different boxes.

- Box 7 – Social Security Tips

- Box 8 – Allocated Tips

Why does the IRS split tips this way—and what does it mean for your tax return?

Let’s break it down in plain English.

Why Tips Show Up Even If You Didn’t “Report” Them

In today’s workplace, most restaurants and bars rely on POS and electronic payment systems. These systems automatically track and report tips, including:

- Credit-card tips

- QR-code or kiosk tips

- Tips recorded directly through POS systems

Because of this automation, employees often don’t feel like they “reported” anything.

But from a tax standpoint, those tips were already reported electronically.

This explains why tips appear on your W-2 even if you never filled out a paper form.

The Big Picture: Box 7 vs. Box 8 (One-Line Summary)

- Box 7 = Tips that were properly recorded through the employer’s system

- Box 8 = Tips the employer estimated and allocated because reported tips appeared low compared to sales

Now let’s look at each box more closely.

Box 7: Tips That Are Already Fully Reported

What Is Box 7?

Box 7 shows tips that are subject to Social Security tax.

These are tips that made it into the employer’s payroll system—usually automatically through POS reporting.

Even if you don’t remember reporting them, these tips are already considered reported for tax purposes.

How Are Box 7 Tips Taxed?

In most cases:

- Box 7 tips are already included in Box 1 (Wages)

- Income tax has been applied

- Social Security and Medicare taxes have already been calculated

For most employees, no additional tax action is needed for Box 7.

Box 8: Why Allocated Tips Exist

Why Does Box 8 Appear?

Box 8 exists because of IRS rules for large food and beverage establishments.

If:

- Total tips reported by all employees

- Appear too low compared to the restaurant’s gross sales

The employer is required to allocate (estimate and assign) additional tips.

Those estimated amounts show up in Box 8 – Allocated Tips.

Important point: This is usually based on restaurant-wide numbers, not on any one employee doing something wrong.

The Most Important Rule About Box 8

Box 8 tips are not included in wages

That means:

- They are not included in Box 1

- Payroll taxes have not yet been calculated

When you see an amount in Box 8, it’s a signal that your tax return may need extra steps.

A Real-World Example

Let’s look at Marco, a restaurant server.

Marco’s Situation

- Hourly wages: $14,000

- POS-recorded tips: $4,000

Because total tips looked low compared to restaurant sales, the employer allocated tips.

Marco’s W-2 Shows:

- Box 1 (Wages): $18,000

- Box 7 (Reported Tips): $4,000

- Box 8 (Allocated Tips): $3,000

How This Is Handled on the Tax Return

Box 7 Tips ($4,000)

- Already included in wages

- Payroll taxes already paid

- Nothing more to do

Box 8 Tips ($3,000)

- Not included in wages

- Payroll taxes not yet paid

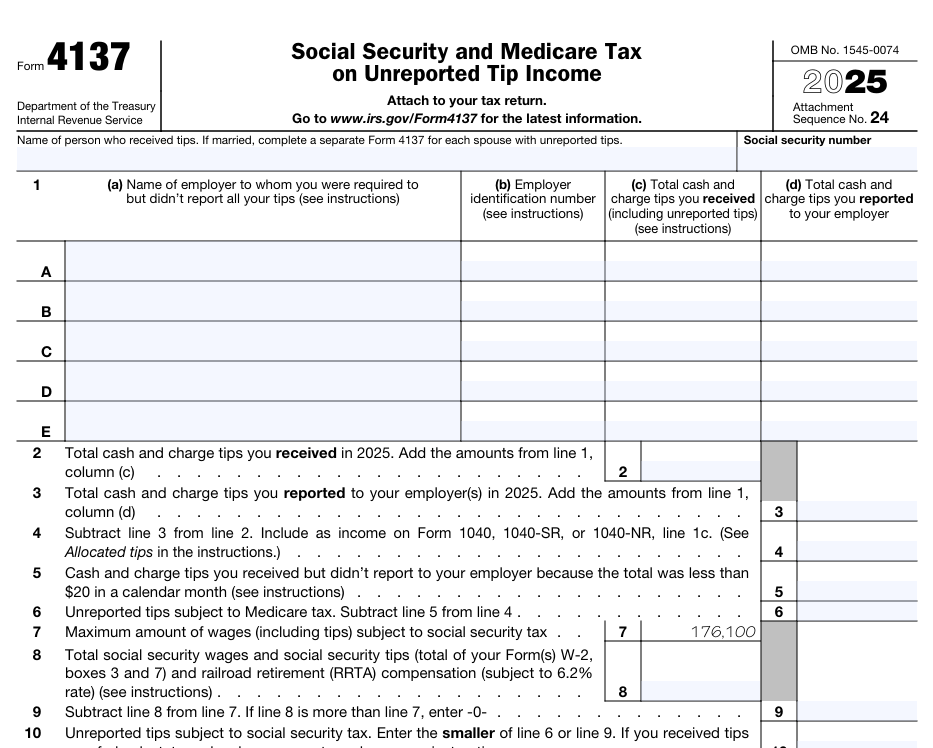

These must be reported using Form 4137

Form 4137: What Actually Gets Entered

Part I – Unreported Tips

- Line 1: Unreported tips → $3,000

- Line 4: Total unreported tips → $3,000

This amount is added to income on Form 1040.

Part II – Additional Payroll Tax

Employee payroll tax rate = 7.65%

- Social Security tax (6.2%): $186.00

- Medicare tax (1.45%): $43.50

Total additional payroll tax: $229.50

This flows through Schedule 2 and into Form 1040.

What About the Tip Deduction?

Marco’s total tips for the year were:

- Box 7 tips: $4,000

- Box 8 tips: $3,000

- Total tips: $7,000

Assuming eligibility in 2025, Marco may claim a Qualified Tip Income Deduction of $7,000 on:

- Schedule 1-A (Additional Deductions)

Important reminders:

- Payroll tax still must be paid

- The deduction reduces income tax only, not payroll tax

“But I Didn’t Actually Receive That Much”

This is a common concern.

- Box 8 amounts are estimates, not confirmations

- You may dispute them only with documentation, such as:

- Daily tip logs

- POS detail reports

- Personal tracking records

Without records, the IRS generally treats Box 8 tips as income received.

Key Takeaways for 2025

- POS systems automatically populate Box 7

- Box 7 = already reported and taxed

- Box 8 = warning sign that Form 4137 may be required

- Form 4137 calculates payroll tax

- Schedule 1-A claims the tip deduction

Correct Filing Flow:

W-2 → Form 4137 → Schedule 1-A → Form 1040

Final Thought

Box 7 reflects tips already handled by the system.

Box 8 is a signal that you may need to take action on your tax return.

Note: This article is intended for informational purposes only and does not constitute tax advice. For personalized guidance, please consult a tax professional.