The New Condo Reality: Rising Costs and Fading Demand

Georgia condo owners are starting to feel many of the same pressures highlighted in the WSJ story —slower sales, more price cuts, and rising HOA and insurance costs—but the picture in Atlanta and Savannah is softer adjustment, not a full-blown crash. For Georgia residents, especially in metro Atlanta and coastal Savannah, the key themes are: condos are harder to sell than a few years ago, fees are climbing, but well‑located units bought before the peak still often have meaningful equity.

https://www.wsj.com/economy/housing/the-condo-market-hasnt-been-this-bad-in-over-a-decade-9f3e7256

Big picture: U.S. and Georgia

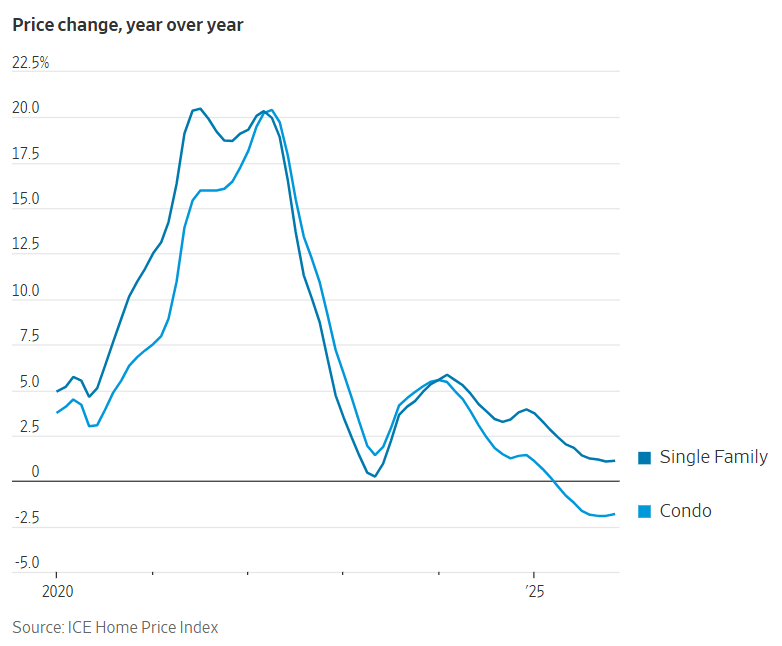

- Nationally, condo prices recently posted their biggest annual decline since 2012, with nearly 1 in 10 condos estimated to be worth less than their last sale price, while only about 4.5% of single‑family homes are in that situation.

- The stress is concentrated in buildings with high or rapidly rising HOA dues, insurance shocks, or large deferred‑maintenance assessments, trends that began accelerating after the Surfside collapse and tighter lender scrutiny.

Atlanta: cooling, not collapsing

- Overall Atlanta home values are down modestly year over year (roughly mid‑single‑digit decline), and the broader market has shifted from a frenzied seller’s market toward a more balanced environment with longer days on market and more price cuts.

- Behind that average, there is a two‑track story: in‑town condos and some high‑HOA communities have seen much steeper resets, with examples of downtown one‑bedroom units that sold around the $400,000 mark a few years ago now sitting closer to $250,000 list prices.

Atlanta real‑life story: “137 days and four price cuts”

- One Atlanta condo owner recently shared that their unit had been sitting for 137 days with four price reductions and still no acceptable offer; online commenters immediately pointed to the roughly $7,300 annual HOA fee as the main reason buyers were walking away.

- This owner was torn between another price cut and renting the unit: the mortgage rate was low, and using it as a rental could at least cover the note and part of the HOA, but they worried about becoming “an accidental landlord” with future special assessments looming.

Atlanta HOA and insurance pressures

- HOA fees across greater Atlanta rose about 12% between 2022 and 2024, roughly in line with national trends, driven by higher insurance premiums and the rising cost of catching up on deferred maintenance and capital projects.

- For buyers running numbers, these fees significantly change affordability: once mortgage, property tax, insurance, and HOA are combined, a condo that looks cheap on list price can cost as much monthly as a smaller single‑family home or townhome with no or low HOA.

Savannah and coastal Georgia: demand vs. risk

- The Savannah housing market overall remains somewhat competitive, with a recent median sale price around $350,000–$370,000 and homes taking longer to sell (roughly 48–88 days on market), but still seeing year‑over‑year price gains.

- On the rental side, strong population growth and job creation are driving demand: apartment occupancy in Savannah has been near 95%, with thousands of new units delivering yet still getting absorbed, which indirectly supports condo rents where short‑term or long‑term leasing is allowed.

Savannah real‑life style case: “Flagler Beach, Florida, comes to mind”

- In nearby coastal markets like Flagler Beach, Florida, owners trying to sell townhouses and condos at roughly their 2020–2022 purchase price have found the market “saturated with places for sale,” forcing delistings and re‑listing at the same or lower price months later.

- Coastal Georgia sellers watching that pattern are increasingly cautious: they understand that hurricanes, flood‑zone insurance, and HOA reserve requirements can quickly flip a “cheap” condo into a negative‑cash‑flow asset if premiums or special assessments jump.

What this means for Georgia residents

- For current owners with low mortgage rates, renting out the unit instead of selling at a discount can be a rational strategy, especially around Atlanta’s job centers and Savannah’s tourism‑driven neighborhoods where occupancy and rents remain solid.

- For buyers, the priority is less about “getting a deal” on the purchase price and more about understanding the building’s financial health: HOA reserves, upcoming capital projects, insurance renewals, and any pattern of special assessments over the past 5–10 years.

Note: This article is intended for informational purposes only and does not constitute tax advice. For personalized guidance, please consult a tax professional.